The minimum details your log must include

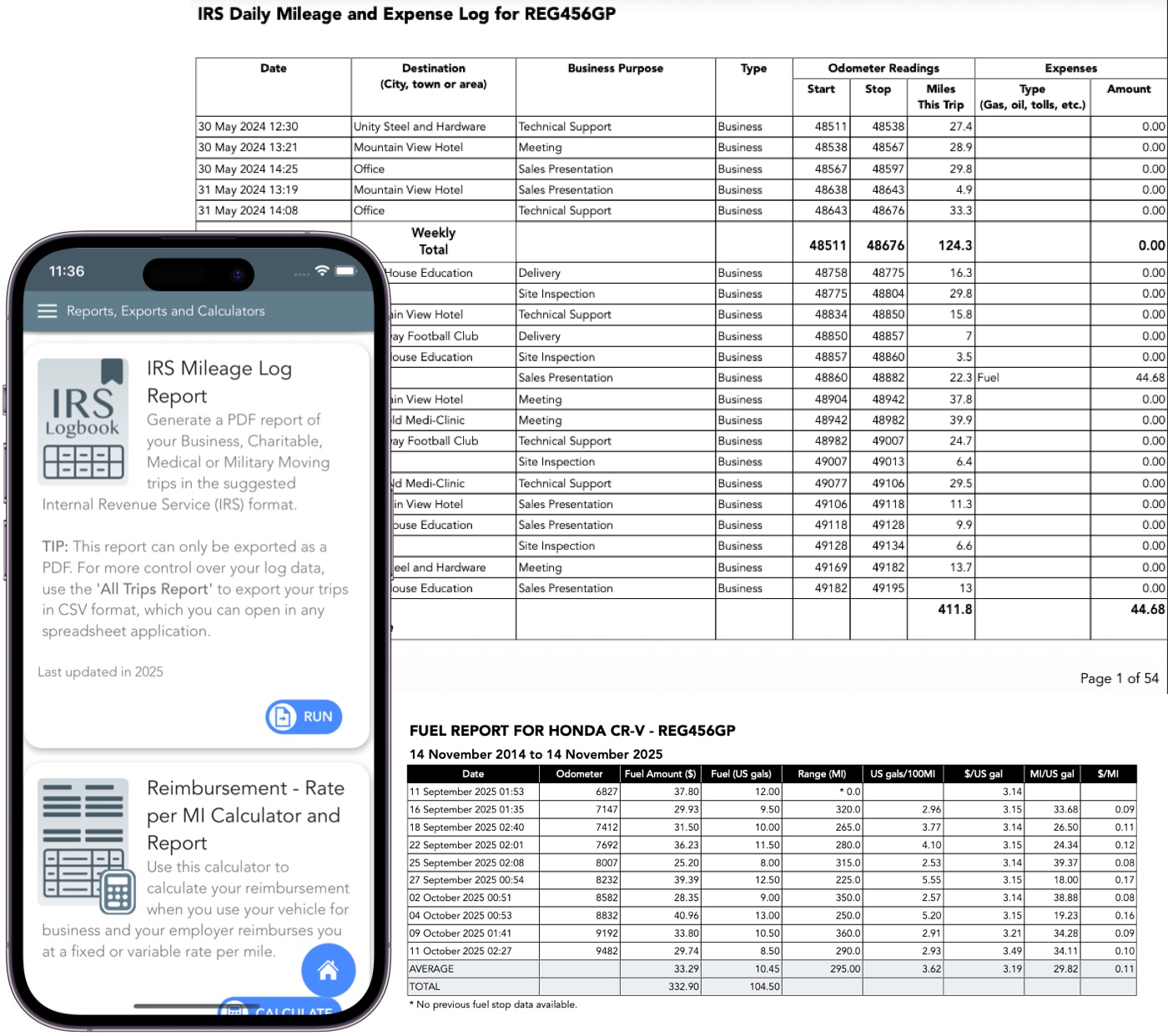

A mileage log that can stand up to an IRS review typically needs:

- Date of each trip

- Business purpose (reason for the trip)

- Starting location

- Ending location

- Start and end odometer readings

- Total miles driven for the trip

Trip Logbook is designed around these fields so your records stay consistent, structured, and easy to verify.